automatic premium loan life insurance

An automatic premium loan taken out against an insurance policy is still a loan and as such does carry an interest rate. Find out about the pros and cons of this clause.

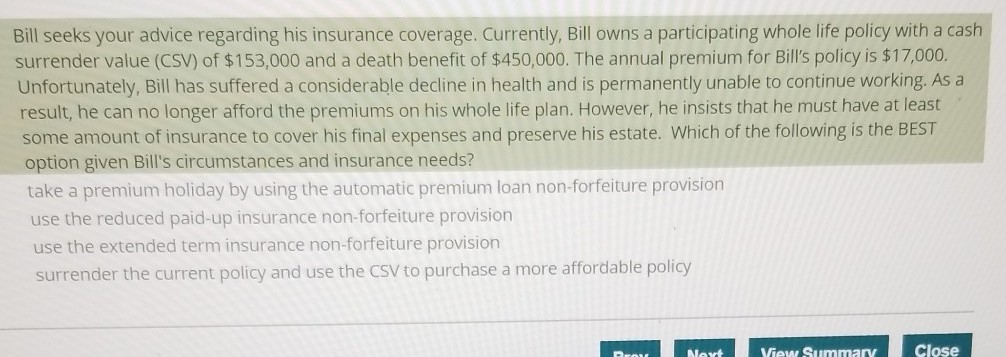

Solved Bill Seeks Your Advice Regarding His Insurance Chegg Com

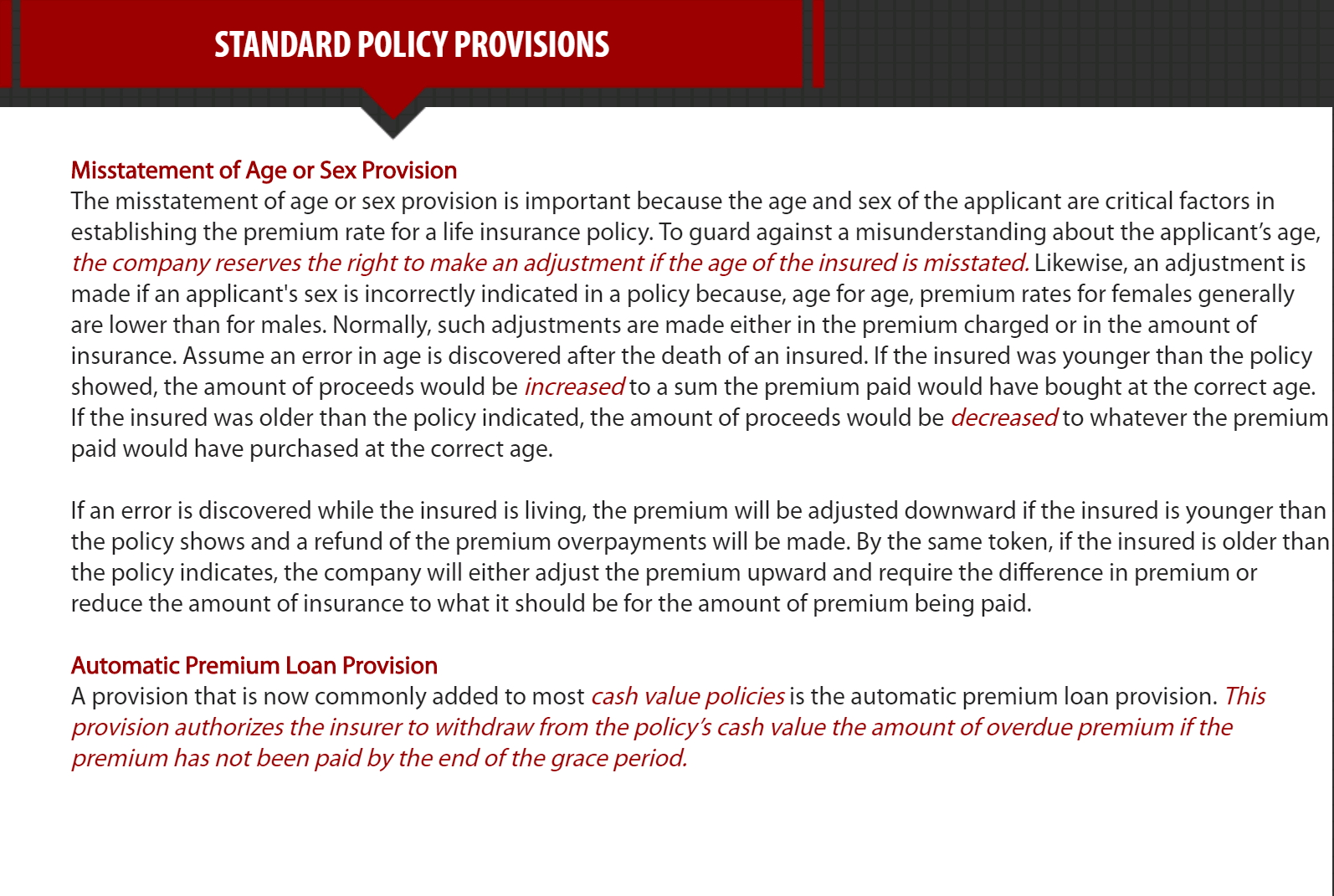

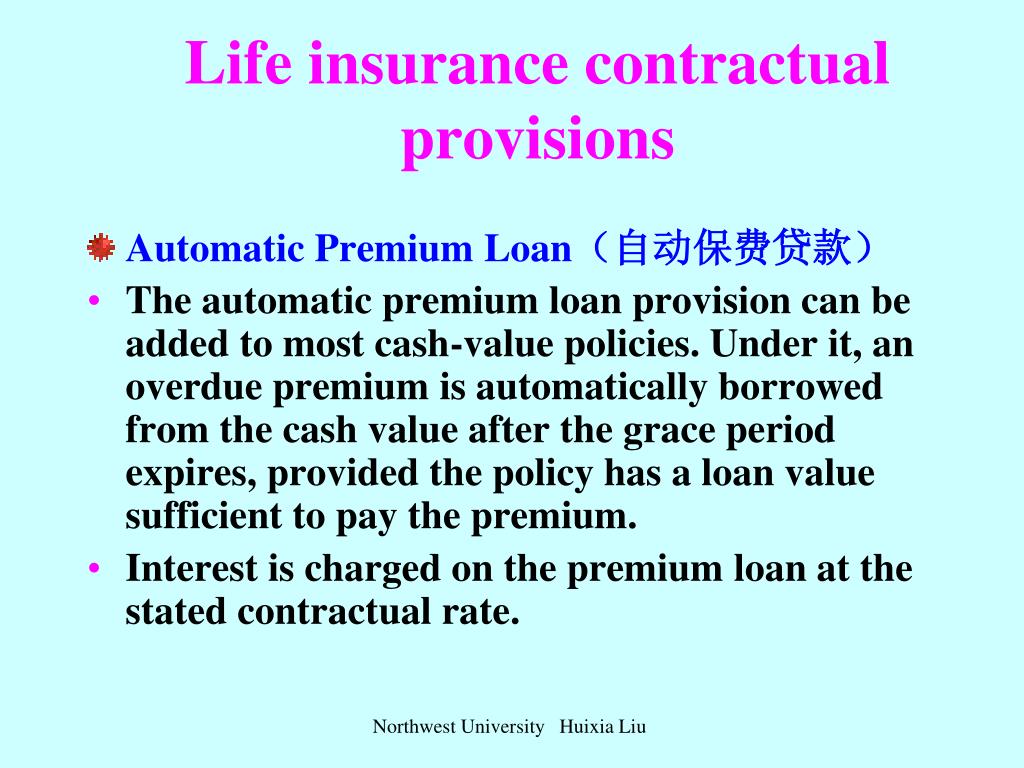

An automatic premium loan provision is a clause in a whole life insurance policy.

. Get the info you need. Your insurance company uses your policys accumulated. Ad Sell your life insurance policy for cash.

Sunday June 12 2022 Breaking News. If you have a whole life. Get the info you need.

Ad Life Insurance For Ages 18 to 85. Maximize your cash settlement. Ad We dont ask your life history to give you life insurance.

Maximize your cash settlement. Term and Whole Life Insurance You Can Rely On. It is a specific clause or rider inside the policy that permits the insurance issuer to pull.

Automatic Premium Loan Provision A provision in a life insurance contract that allows for the payment of premiums from the cash value of the policy if premiums are not paid when due. The amount you can borrow is represented as a percentage of the cash value. Loans are available on life insurance policies when there is enough cash value.

Basically the clause means that the insurance company can. It is a specific clause or rider within the policy that allows the insurance issuer to withdraw. An automatic premium loan is frequently associated with a life insurance policy that has a cash value.

An automatic premium loan is often associated with a life insurance policy that has a cash value. Hence policyholders need to take out such policies to be able to obtain automatic premium. Automatic Premium Loan an optional provision in life insurance that authorizes the insurer to pay from the cash value any premium due at the end of the grace period.

An automatic premium loan provision is protection against whole life policies lapsing due to a missed payment. An automatic premium loan taken out against an insurance policy is still a loan and as such does carry an interest rate. An automatic premium loan APL is a provision in an insurance policy that allows the insurer to deduct the amount of an outstanding premium from the policys value when the.

An automatic premium loan is an insurance policy provision that allows the insurer to deduct the amount of an outstanding premium from the value of the policy when the premium is due. Ad Sell your life insurance policy for cash. No Medical Exam - Simple Application.

Get a quick and easy quote now. Guaranteed life insurance with no exam no hassles. The automatic premium loan clause is a clause that is commonly found in cash value life insurance policies.

Find out if you qualify in under 10 minutes. Term and Whole Life Insurance. Rates starting at 11month.

The automatic premium loan provision is a feature of some life insurance policies that allows the policyholder to borrow money from the policys cash value to pay the premium. Monday July 11 2022 Breaking News. At Life Benefits we add the Automatic Premium Loan APL provision to all whole life policies we sell.

An automatic premium loan provision is a clause included in some cash value life insurance policies that allows the insurance company to deduct the premium from the policys. Ad Life Insurance You Can Afford. Compare Plans to Fit Your Budget.

It states that should a policyholder fail to make a scheduled premium payment money from the. Whole life coverage with an automatic premium loan provision can protect your policy if you cant pay. Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency.

There is no cost to add the provision to a policy and there have. An automatic premium loan is a feature of cash-value life insurance policies. Ad No Exam Just Health Other Info.

Find out if you qualify in under 10 minutes.

Why You Should Be Careful With Life Insurance Policy Loans Forbes Advisor

Chapter4 Life Insurance Policies Provisions Options And Riders Life And Heal Insurance License 0 0 1 文档

Return Of Premium Life Insurance Global Investment Strategies

Ppt Lecture Nineteen Twenty Life Insurance Contractual Provisions And Buying Life Insurance Powerpoint Presentation Id 6179153

What Is An Automatic Premium Loan An Automatic Premium Loan Is A Provision In Some Insurance Policies That Allows An Insurer To Pay An Overdue Premium On Your Behalf By Automatically

Chapter 12 Life Insurance Contractual Provisions Ppt Video Online Download

Which Life Insurance Policy Would Be Eligible To Include An Automatic Premium Loan Provision Important Facts Krostrade

What Is An Automatic Premium Loan An Automatic Premium Loan Is A Provision In Some Insurance Policies That Allows An Insurer To Pay An Overdue Premium On Your Behalf By Automatically

How To Rescue A Life Insurance Policy With A Loan

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

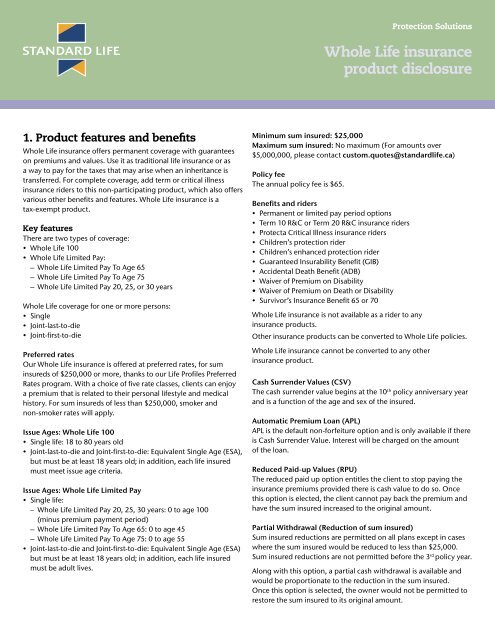

Whole Life Insurance Product Disclosure 6326

Automatic Premium Loan Cash Value Life Insurance Premium Insurance Concept Explained Youtube

State Life Insurance Waliahmedslic Twitter

Life Insurance Policy Loans Tax Rules And Risks

Application Form For Life Insurance

Solved Which Of The Following Lypets Of Whole Life Policies Chegg Com

What Is An Automatic Premium Loan An Automatic Premium Loan Is A Provision In Some Insurance Policies That Allows An Insurer To Pay An Overdue Premium On Your Behalf By Automatically